Amid the global wave of agricultural modernization, investing in an NPK compound fertilizer production line is highly feasible, and can be analyzed from four core perspectives.

Global market demand provides solid support. The world’s population is expected to exceed 9 billion by 2050. Food security is driving increased crop yields, and NPK compound fertilizers, with their precise ability to adjust the ratio of nitrogen, phosphorus, and potassium, are becoming a necessity. Data from the International Fertilizer Industry Association indicates that the global market size will exceed US$150 billion in 2024, a 5% annual growth rate. Major agricultural economies in Asia and South America, such as China, India, and Brazil, will account for over 60% of global demand. Furthermore, with the advancement of global agricultural mechanization, granular NPK compound fertilizers are suitable for mechanical fertilization, further expanding the market.

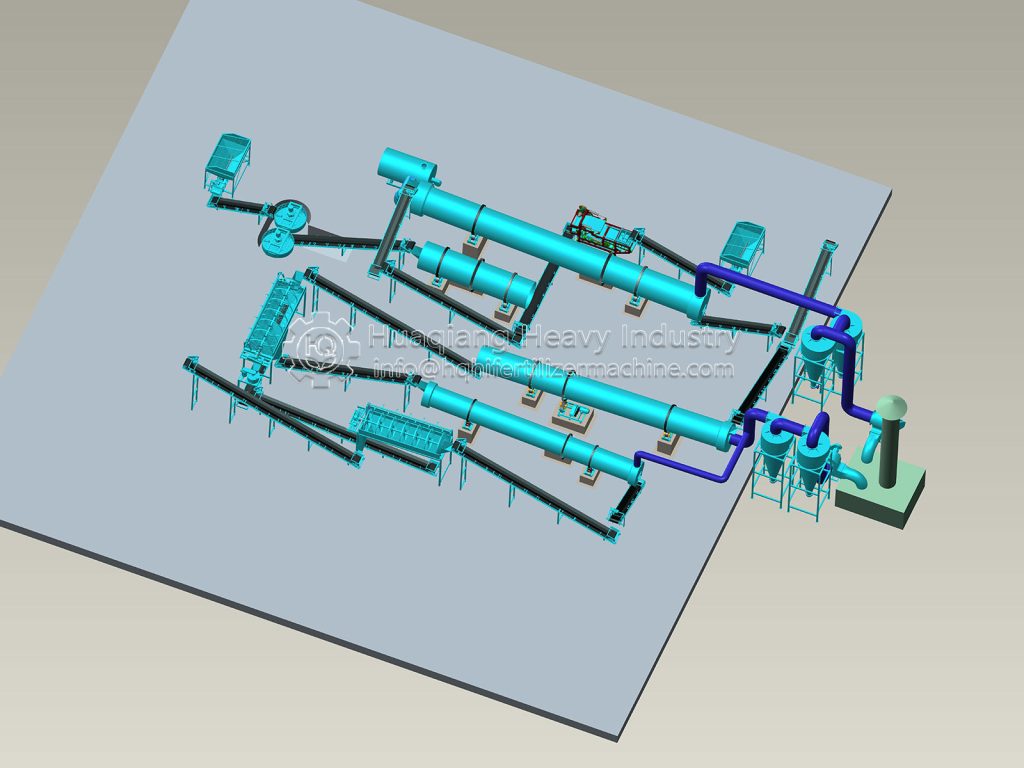

Technical maturity ensures project implementation. A complete global process system has been established: batching – mixing – granulation – drying – screening – packaging. While Europe and the United States are seizing the high-end market with tower granulation technology, developing countries like China have independently developed agglomeration and slurry methods, combining low cost with strong adaptability, and are widely used in Southeast Asia and Africa. Key equipment such as disc granulators and drum dryers have a failure rate of less than 5%, and combined with automated control systems, they can meet the scale-up production needs of various regions.

Cost-effectiveness highlights profit potential. Different regions have varying cost advantages: the Middle East and Russia rely on mineral resources to reduce raw material costs, while Southeast Asia and South Asia rely on low-cost labor to reduce labor expenses. For example, a 100,000-ton annual production line in Southeast Asia would require equipment investment of approximately $15 million, with raw material costs accounting for 65%. Given the local selling price of $800-1200 per ton, the average annual net profit is $6-8 million, with a payback period of 2.5-3.5 years. Further cost reductions can be achieved through energy-saving technologies.

The policy environment has provided strong momentum. To ensure food security and sustainable agricultural development, countries around the world have introduced favorable policies: the European Union offers tax breaks to companies producing environmentally friendly NPK compound fertilizers; the United States supports production and research through the Farm Bill; and China promotes the reduction and efficiency of chemical fertilizers, offering land and environmental impact assessment incentives. These policies reduce operating costs and expand market potential.

In summary, from a global perspective, NPK compound fertilizer production lines offer advantages in market, technology, cost, and policy, are highly feasible, and can create economic and social benefits for investors.